maricopa county tax lien foreclosure process

If you pay off the amount of the lien or the purchase price depending on the situation plus allowed costs like interest within a specified time period you get to keep the home. CoNLL17 Skipgram Terms - Free ebook download as Text File txt PDF File pdf or read book online for free.

Arizona Tax Liens What You Need To Know Tltv Ep 15 Youtube

We would like to show you a description here but the site wont allow us.

. Must contain at least 4 different symbols. Property tax delinquencies and HOA delinquencies that could result in foreclosure. Permit department said i could build on my property so i purchased a metal building 1500sqft for 20k engineering another 8k.

Please contact the Assessor s Office 506-3406 for the latest valuation information on your property. Foreclosing a Tax Lien - Table of Forms. The UKs tax authority wanted to help small businesses get their taxes right the first time.

After a tax lien sale you still own the home because the purchaser only buys a lien against your property. Real estate agents are paid a commission based on the propertys sale price. Sonoma county building permit have screwed me completely.

Get breaking Finance news and the latest business articles from AOL. The Natural people must begin to lien those who order them and execute them in both their private citizen capacity and their professional capacity. Tiarra Earls Haas Communications Officer Maricopa County AZ.

Recording the judgment at the County Recorders office. For SaleFor Lease Sign ARS 33-1808Condo ARS 33-1261. From stock market news to jobs and real estate it can all be found here.

290 136 P2d 270 274. Greenville County 188 SC. Notice of Intent to File Foreclosure Action.

6 to 30 characters long. ASCII characters only characters found on a standard US keyboard. They possess a tax ID number and an incorporation date.

I got started on the process of obtaining building a permit to errect this building. Waiver of Service of Summons. Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language.

HAF funds can also be used to pay homeowner utility delinquencies and delinquent insurance with a maximum assistance total of 25000 per household. - -- --- ---- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- -----. Transparency throughout County Govt.

Diff git agitattributes bgitattributes index 74ff35caa337326da11140ff032496408d14b55e6da329702838fa955455abb287d0336eca8d4a8d 100644 agitattributes. A Texas tax collected on private telegraph messages sent out of the state imposed an invalid burden on foreign and interstate commerce and insofar as it was imposed on official messages sent by federal officers it constituted an unconstitutional burden on a federal instrumentality. The Maricopa County Assessor determines property values and provides notification of valuation.

King County increased press release engagement by 33 percent when it deployed a new media relations strategy. Doing it the legal way obtaining a permit is a joke and a depravation of property rights. Application and Affidavit of Default.

Can I file a lien even though I dont have a written contract And as with most of the questions we get about mechanics lien rights the answer is. If the tax lien is not redeemed. And whatever mark.

The following question pops up frequently on construction projects. ERAP Assistance in Maricopa County PDF Program Data. To my surprise i.

Judgment Foreclosing the Right. Maricopa County will not be held responsible for legal or court fees when the judicial foreclosure process is stopped due to redemption payments made in an untimely manner. Saving Your Home After a Tax Lien Sale.

Request for Default Hearing and Order. The association may choose to garnish wages rent or a bank account held by the property owner. Handshakes and verbal agreements are common in the construction industry but finding answers on how lien rights apply to contracts.

Township or countys yearly Tax Lien Sale. By filing false tax returns Dayspring also. The homeowner has to pay back the lien holder plus interest or face foreclosure.

Recording the judgement provides the association with a lien effective at conveyance. Tenant eviction assistance for City of Mesa residents. Fixing Our Very Broken Building Permit Process.

All requests regarding tax liens such as requests for assignments sub-taxing reassignments merge vacate and Treasurers deeds should be sent to Maricopa County 301 W. Foreclosing a Tax Lien. Tax foreclosure can occur in as little as one year though most states allow a property to get 2 years behind in taxes before seizing it.

Complaint to Foreclose the Right to Redeem a Tax Lien. Ralls County Court v. The total commission is split among the agents and the brokers involved.

The town holds these sales in hopes of making back the cost of the unpaid property and real estate taxes so the properties are usually auctioned at a. United States 105 U. See the platform defining the future of civic engagement.

Is assessed and during the sixteenth month the Treasurers Office offers a tax lien ON THE PROPERTY for sale. The tax collector uses the money earned at the tax lien sale to compensate for unpaid back taxes.

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Download Free California Lien Release Form View Forms Samples And Spreadsheet Of Cal In 2022 Doctors Note Template Rental Agreement Templates Cover Letter For Resume

Is Arizona A Tax Lien Or Tax Deed State The Answer May Surprise You Tax Lien Certificates And Tax Deed Authority Ted Thomas

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

The Statutory Requirements For Purchasing Redeeming And Foreclosing On Tax Liens In Arizona Provident Lawyers

Download Free California Lien Release Form View Forms Samples And Spreadsheet Of Cal In 2022 Doctors Note Template Rental Agreement Templates Cover Letter For Resume

2021 Tax Lien Information Public Notices Azdailysun Com

Is Arizona A Tax Lien Or Tax Deed State The Answer May Surprise You Tax Lien Certificates And Tax Deed Authority Ted Thomas

How To Find Tax Delinquent Properties In Your Area Rethority

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

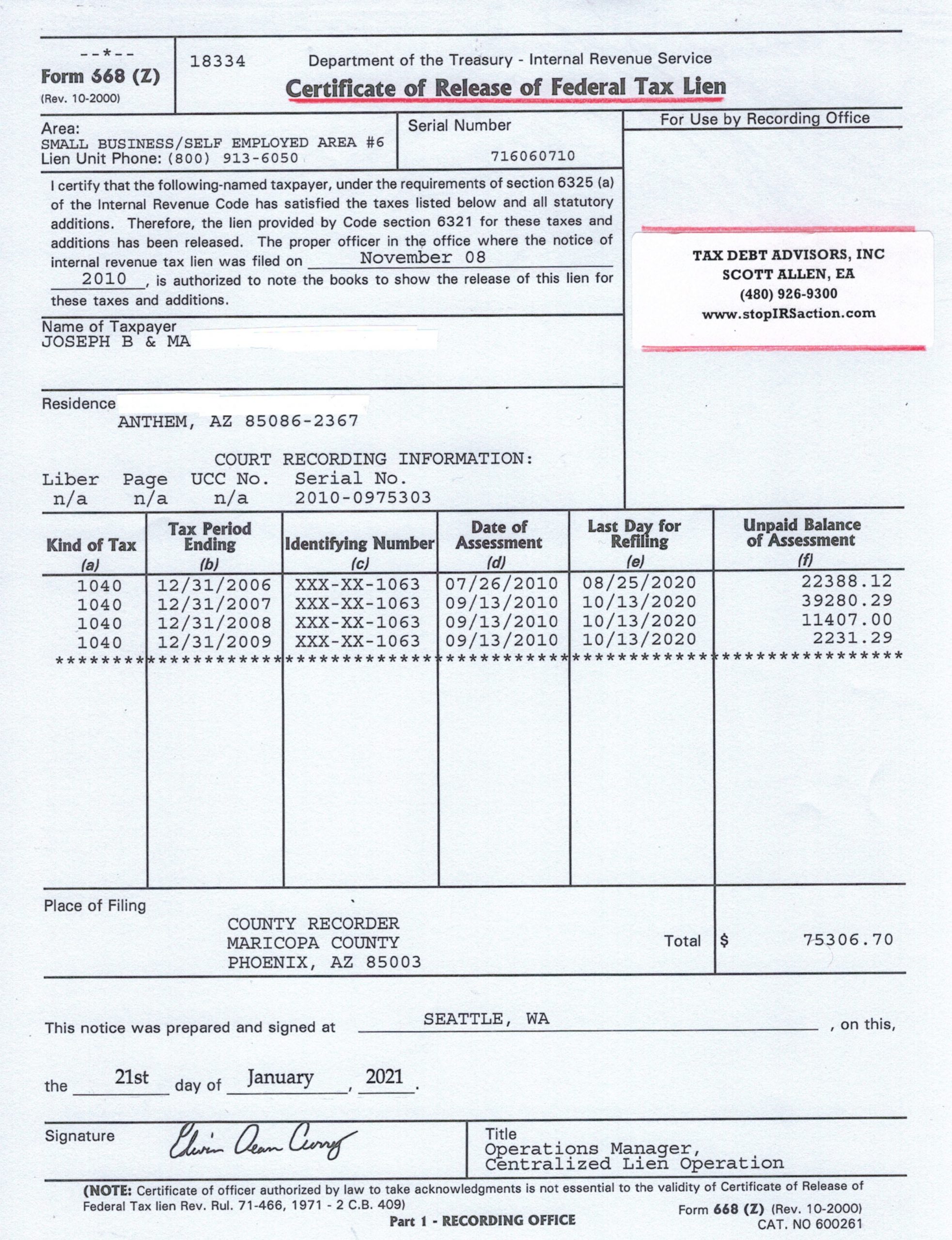

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

Tax Liens Tax Lien Foreclosures Arizona School Of Real Estate And Business

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc